Comparison of NeXa with Gemini Advanced

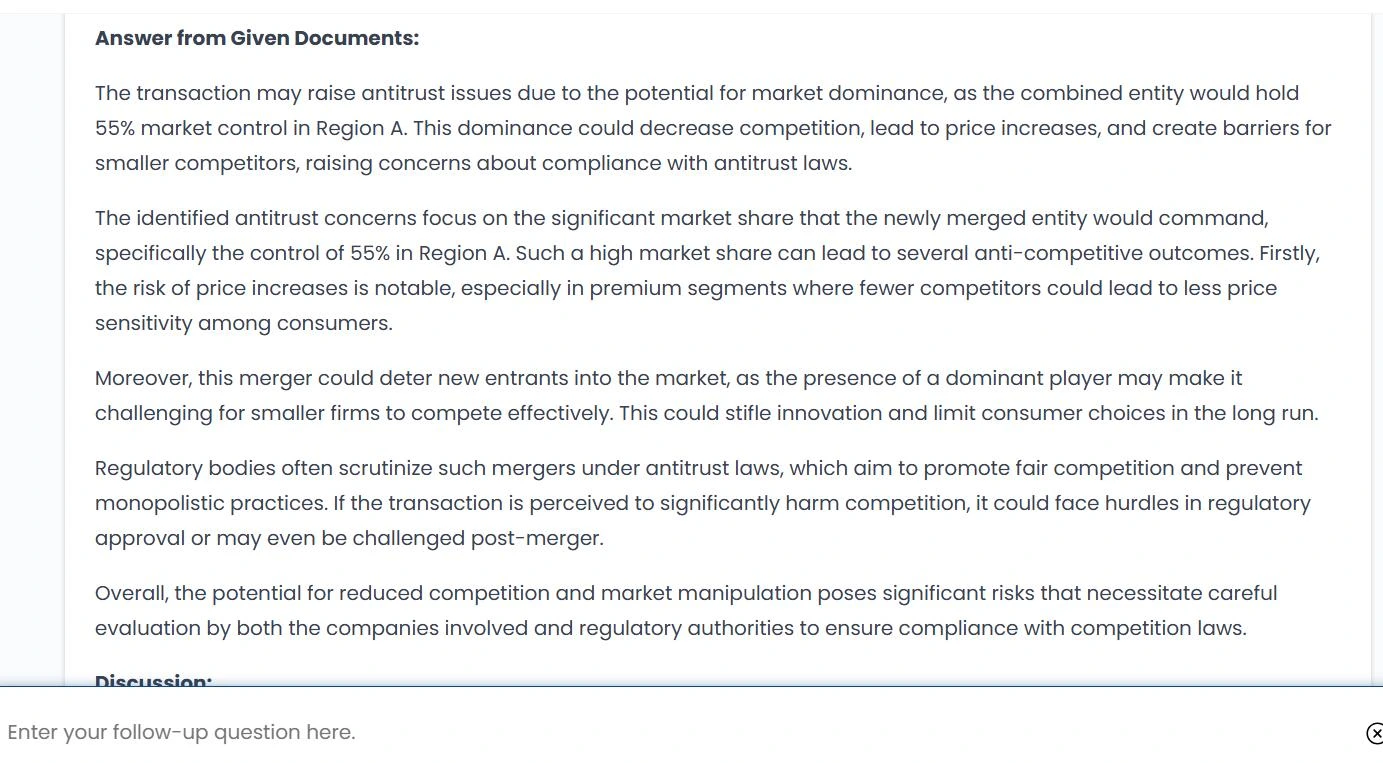

Use Case 1: Identify any potential antitrust or competition law issues that could arise from the transaction.

Files that uploaded: Merger Analysis Report from Company X

Gemini Answer:

NeXa’s answer:

The NeXa answer is superior due to its comprehensive analysis, structured format, and inclusion of relevant case law. It not only identifies key antitrust issues but also contextualizes them within existing legal frameworks, making it a more robust response for understanding potential competition law implications arising from the transaction. The Gemini answer, while informative, lacks the depth and specificity necessary for a thorough legal analysis.

Comparison of NeXa with ChatGPT

Use Case 2: Are there any thresholds for mandatory notifications under local or global regulatory bodies (e.g., ACCC, FTC, CMA)?

Files that uploaded: Merger Analysis Report from Company X

ChatGPT Answer:

NeXa’s answer:

The answer provided by NeXa is more comprehensive in scope and depth compared to my earlier response. Here’s why it could be considered better:

1. Detailed Legal Analysis: It dives into specific case laws (e.g., FTC v. Steven J. Dorfman and FTC v. Elite IT Partners), explaining how these rulings clarify the FTC’s enforcement powers and compliance obligations. My response did not explore specific cases or their implications.

2. Statutory Frameworks: The answer integrates various legislative acts (e.g., the Hart-Scott-Rodino Act, Federal Trade Commission Act, and Dodd-Frank Act) to provide a thorough overview of different regulatory thresholds. My response focused more on high-level jurisdiction-specific rules without citing statutes.

3. Broader Context: It goes beyond just the FTC, ACCC, and CMA, touching on sectors like environmental regulations, consumer safety, and securities law. This showcases the interconnected nature of notification thresholds across industries, which I did not address.

4. Structured and Thematic: The answer follows a clear structure—starting with an introduction, progressing through case law and statutory discussion, and ending with a conclusion. My response was a succinct summary focused on specific regulatory bodies without delving into overarching themes.

5. Use of Precedent and Interpretation: It emphasizes the role of evolving legal interpretations (e.g., post-AMG Capital Management) and connects these changes to practical compliance implications. My earlier response lacked this depth in demonstrating how legal precedents shape regulatory practices.

Comparison of NeXa with Perplexity

Use Case 3: Please provide an overview of the company’s financial position as reflected in these financial statements in the USA.

Files that uploaded: Balance Sheet, Cash Flow Statement and Income Statement from Company X

Perplexity Answer:

NeXa’s answer:

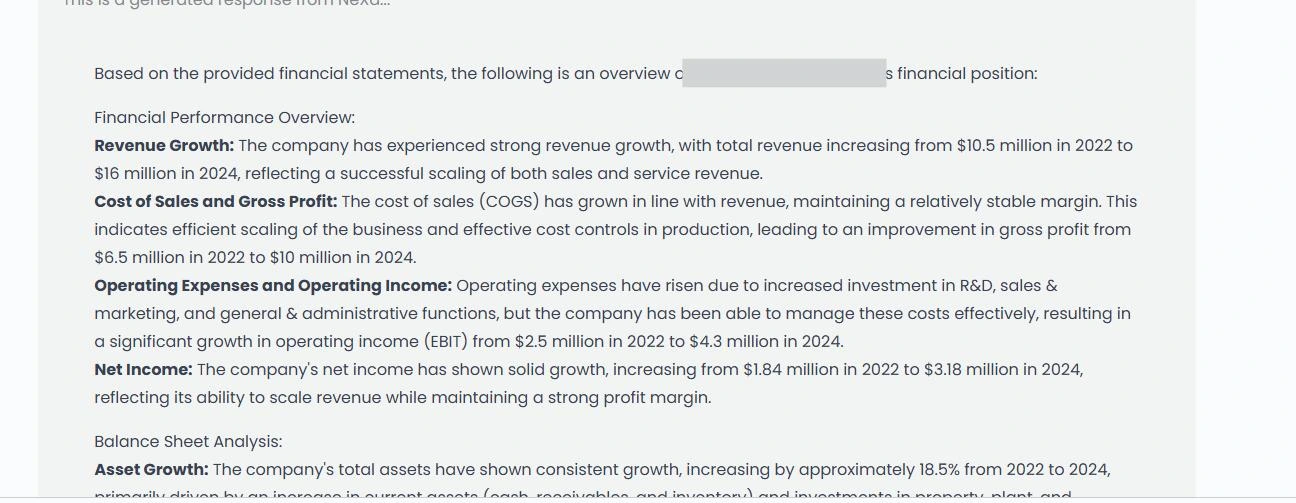

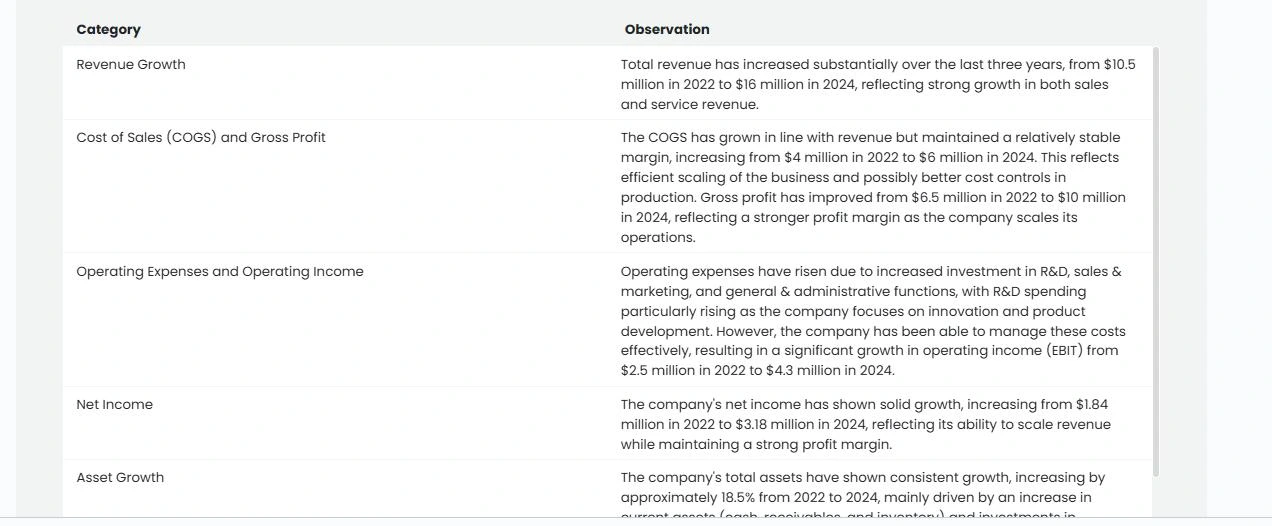

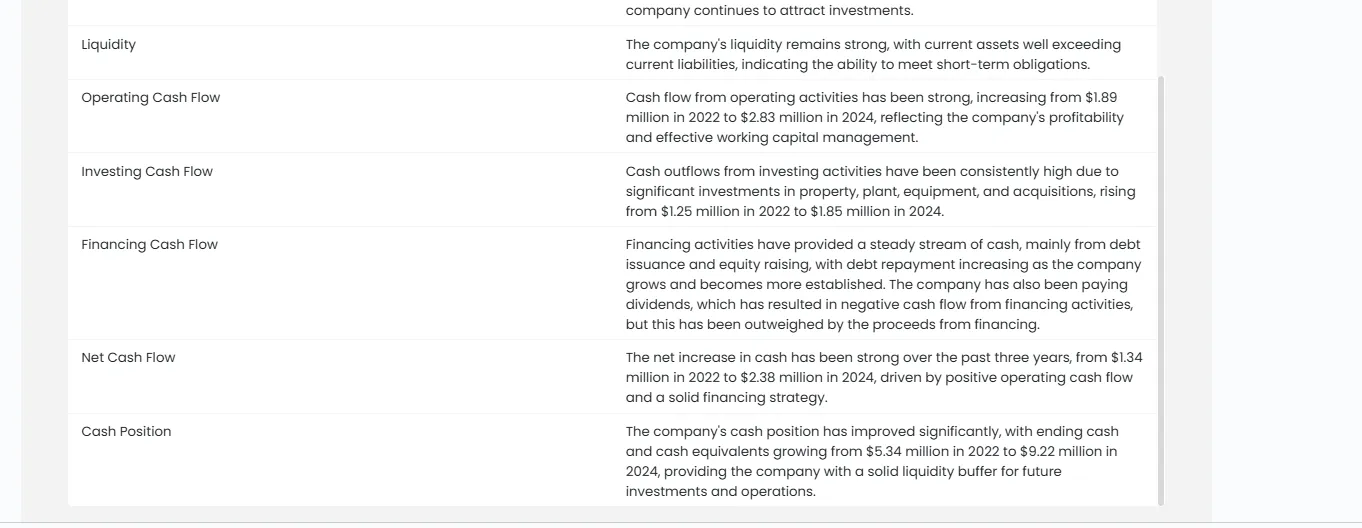

The answer provided by NeXa offers a detailed and structured overview of Company X financial position, covering critical aspects such as financial performance, balance sheet analysis, and cash flow analysis. Here’s a comparison of the two responses:

Strengths of the NeXa’s Answer:

Detailed Financial Performance: It breaks down revenue growth, cost of sales, gross profit, operating expenses, and net income with specific figures over multiple years, providing a clear picture of the company’s financial health.

Balance Sheet Insights: The analysis includes asset growth, liability trends, and equity changes with percentage increases, which helps in understanding the company’s financial stability.

Cash Flow Analysis: It effectively summarizes cash flows from operating, investing, and financing activities while providing insights into cash position and liquidity.

Clear Structure: The answer is well-organized into sections that make it easy to read and understand.

Comparison of NeXa with Claude

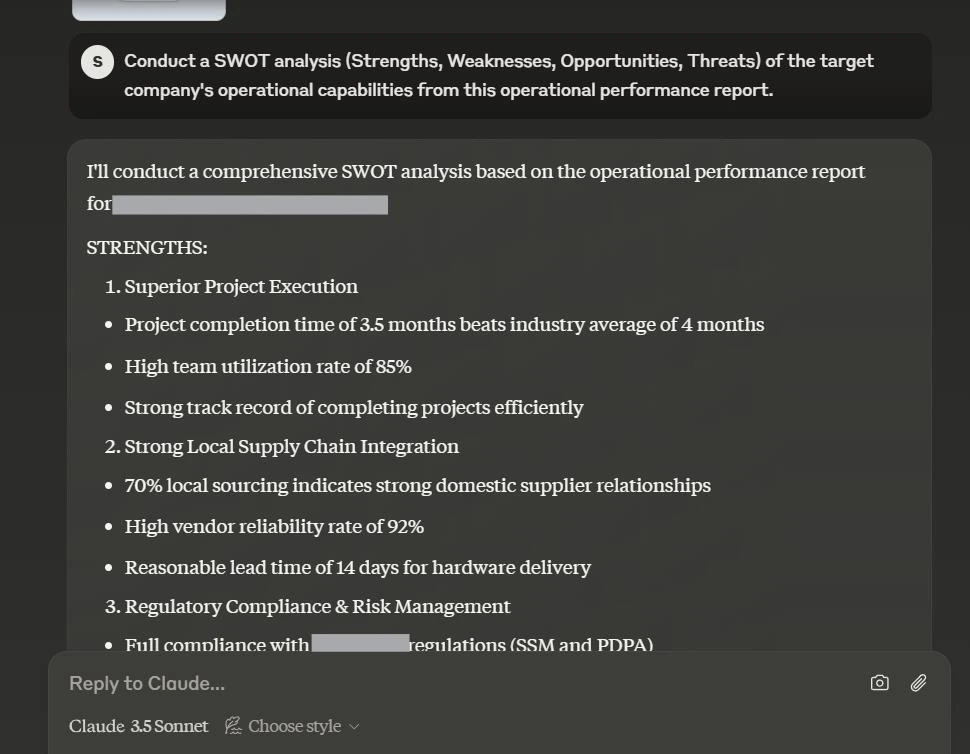

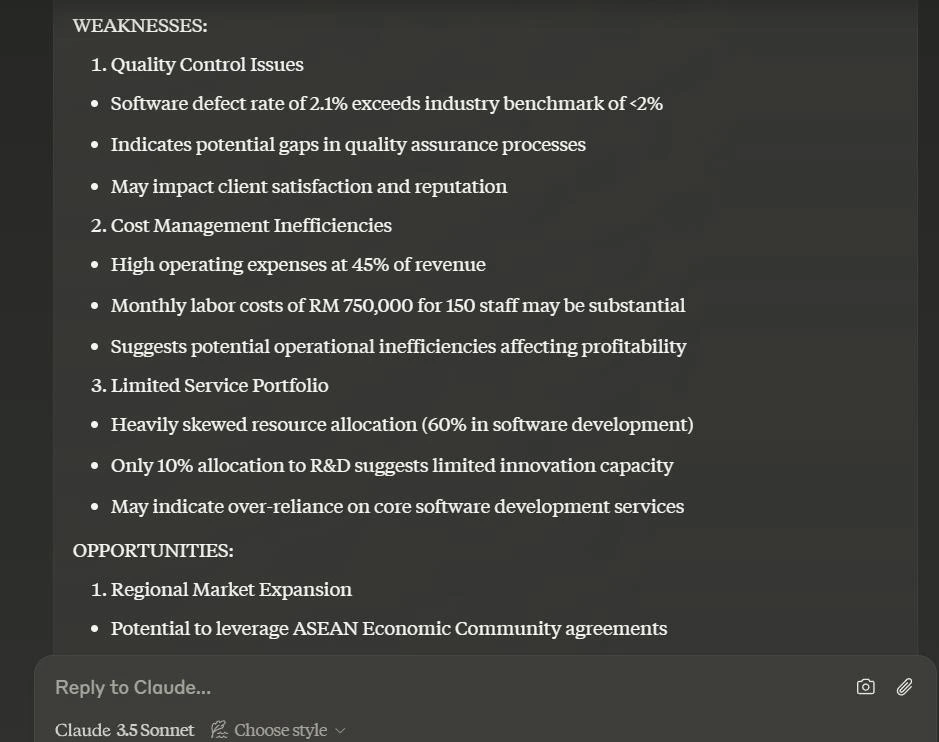

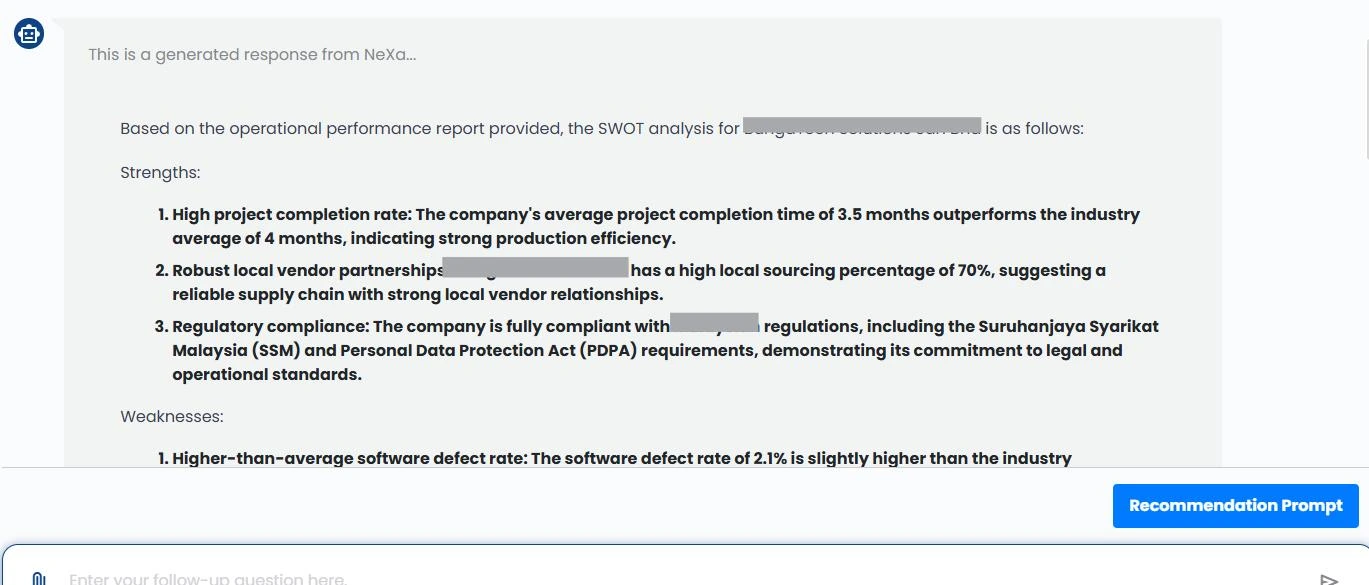

Use Case 4: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) of the target company’s operational capabilities from this operational performance report.

Files that uploaded: Operational Performance Report of Company X

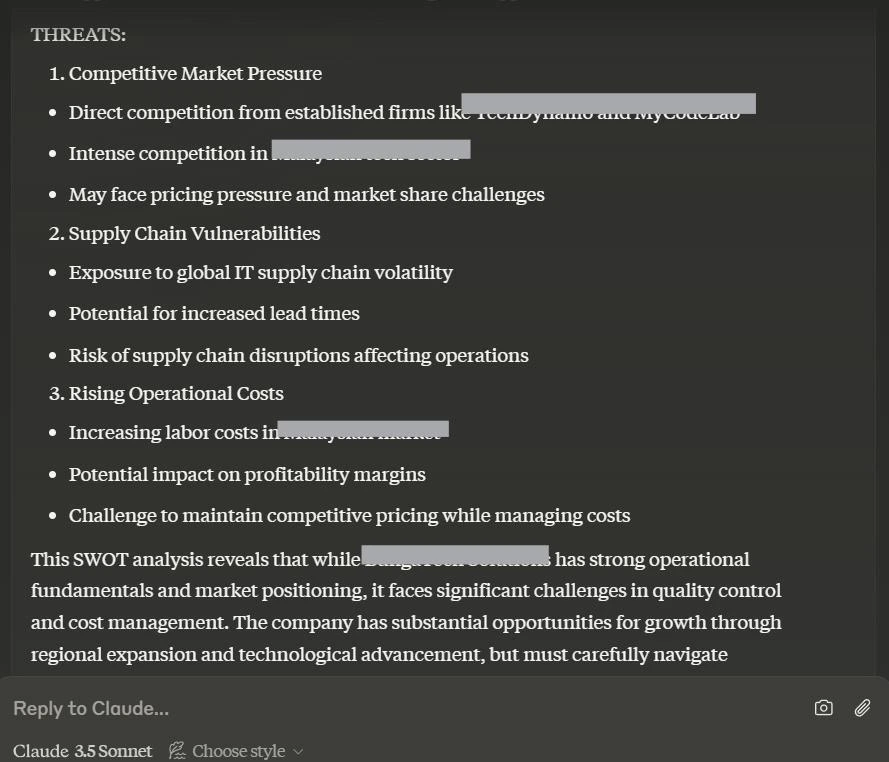

Claude Answer:

NeXa’s answer:

Both answers provide a clear and detailed SWOT analysis, but the NeXa’s answer is better overall for the following reasons:

1. Structured Recommendations: The first answer includes specific and actionable recommendations at the end (e.g., optimize cost management, enhance quality control, diversify revenue streams), making it more solution-oriented.

2. Conciseness and Clarity: The first answer conveys the same points as the second but in a more concise and focused manner, making it easier to digest.

3. Detailed Context for Weaknesses: The first answer highlights specific operational inefficiencies, such as over-reliance on software development and high defect rates, with clear links to their potential consequences.

4. Balanced Tone: The first answer provides a more balanced view of opportunities and threats, connecting them to the company’s existing strengths and weaknesses.